The 52-Week Money-Saving Challenge Can Put $5,000 Back in Your Bank Account

Saving money is both one of the most simple ideas (just don’t spend money, so easy!) but also one of the most frustrating ones to actually follow through on. Whether you’re splurging on something nice for yourself or an unexpected bill pops up out of nowhere, money can always seem to be flowing in one direction: out of your pocket. That can, of course, lead to hefty amounts of debt piling up and cause the anxiety that comes along with it to grow all the more overwhelming. Instead of taking out a loan or charging everything to yet another credit card, it might help to break things down into a long-term strategy.

For example, those who are determined to stow away some cash this year might find the 52-week challenge to be just what they need to stay on track. There are a few different methods you can try when it comes to this money-saving challenge, but each of them involve saving an allotted amount of money each week for a full year. No matter how much you decide to stash each week, the goal is to ultimately have a pretty nice stack of cash at the end of the year.

Take a look to see how the 52-week money-saving challenge can help you save with two popular methods!

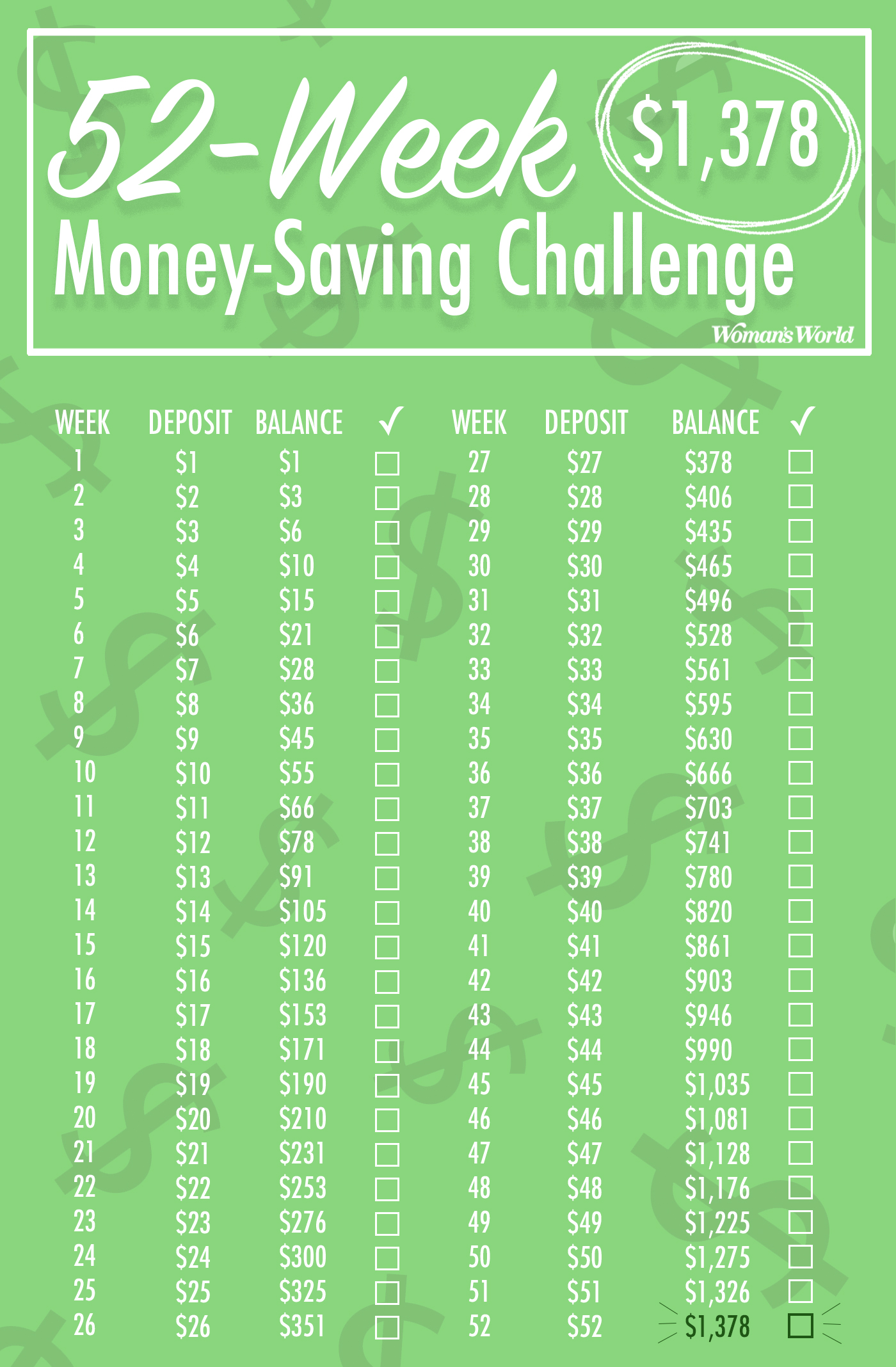

52-Week Money-Saving Challenge: $1,378

This strategy is easy to follow with each weeks’ increments of saving matching the number of said week. It’s perfect for someone who wants more than $1,000 to look forward to at the end of the year, but doesn’t want to commit to squirreling away much more than $50 on any given week. That said, if you’re looking to really make your weekly savings add up, you can try the more substantial technique below.

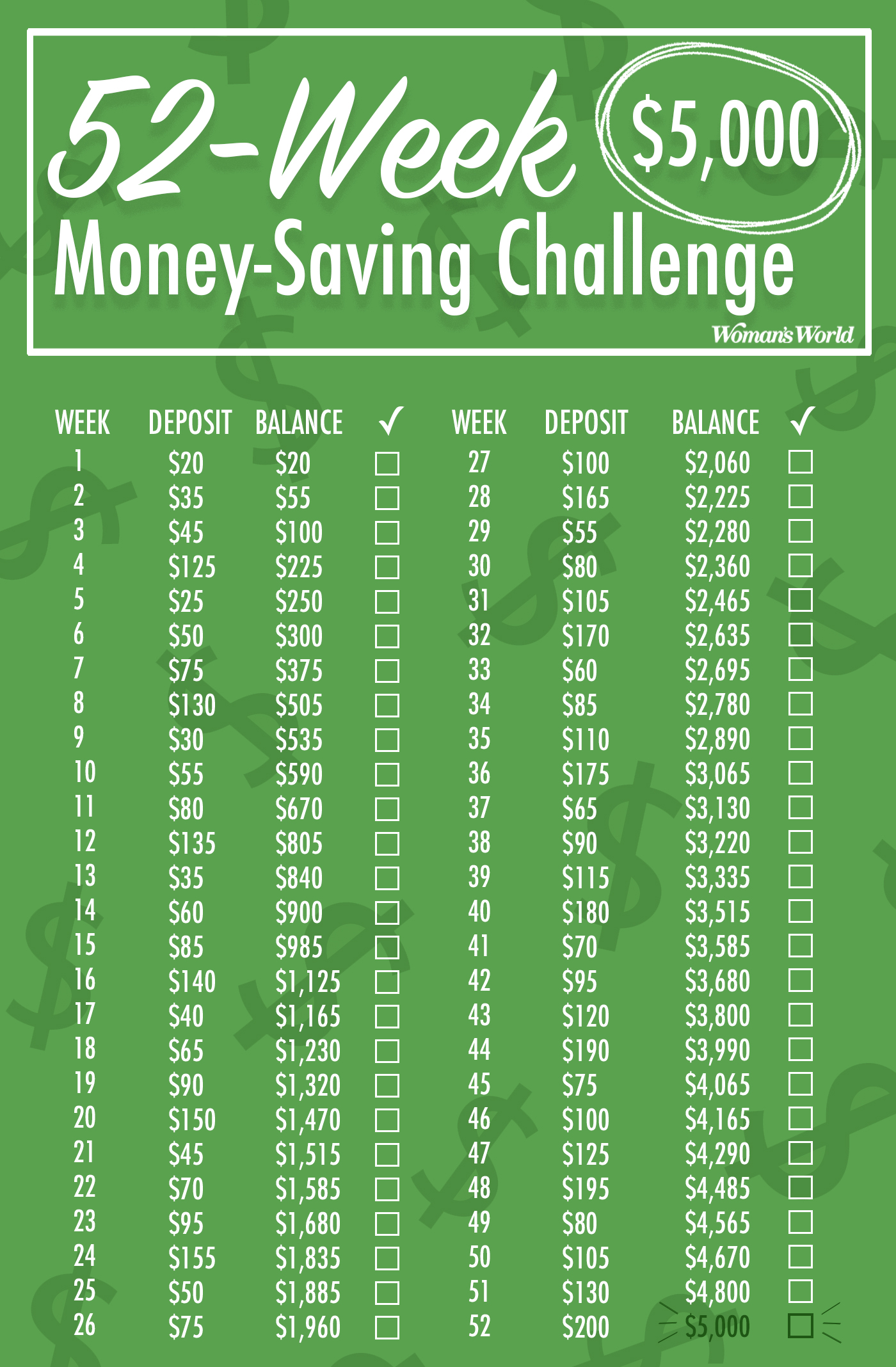

52-Week Money-Saving Challenge: $5,000

This idea does require stashing away the occasional three-digit amount of money each week, so it’s not something you can jump into if you can’t comfortably deposit up to $200. That said, other weeks require as little as $20 to $45. The alternating variety helps lessen the blow when larger sums are necessary to make it to the $5,000 at the end of the year.

Whichever method you decide to go with, the beauty of this money-saving challenge is how adaptable it can be to any family’s budget. After all, you don’t want to go broke while trying to save money — that would defeat the whole point! But with some careful planning, you can find yourself with more than a few extra bucks in your pocket in just a year’s time.

More From Woman’s World

‘Rent a Grandma’ Can Help You Earn Money Using Your Greatest Skill: Love

Why Finding an Empty Can of Coke Could Earn You Thousands

Retirees Get to Travel the US While Making Money ‘Inn-Sitting’