What You Need to File Your Taxes: Checklists, Guides, and References That Will Make Life Easier at Tax Time

Follow this handy guide to save yourself from tax confusion.

When tax season rolls around, it’s time to start pulling together the information you’ll need to file your return. These checklists can help you get organized based on the income you generated during the past year and the deductions you may be able to take.

Documents: Getting Started

What You’ll Need

Gather these items first:

- Last year’s tax return and supporting documents

- Social Security or tax ID numbers for you, your spouse, and any dependents

- Your bank account and routing numbers

Income Tax Forms

How did you make money over the year?

- W-2. If you worked as an employee

- 1099-MISC. If you worked as an independent contractor

- 1099-INT. If you earned interest from a CD or savings account

- 1099-DIV. If you earned dividends or capital gains from a taxable account

- 1099-G. If you received unemployment compensation

- 1099-R. If you received payments from a pension, retirement plan, IRA, or annuity

- 1099-SSA. If you received Social Security

Deduction Documents

What deductions might you take? If your tax year included the below activities, gather supporting receipts, bills, and other records to maximize your deductions:

- Paid child care expenses, such as for day care or a babysitter

- Made donations to charity

- Paid for your own health insurance or other health care expenses

- Had expenses related to being self-employed (e.g., home office, advertising, desk supplies)

- Traveled or relocated for work purposes

- Contracted career services for a job search

- Made tax-deductible home improvements, such as an energy-efficiency upgrade

Tax Form Checklist

In January, you received tax statements in the mail to account for the past year’s income. Here’s a cheat sheet for the most common forms. If you have multiple employers or banks, you should get separate forms from each. Print this list or save it to your personal computer and keep it handy. Fill in the name of each company you’re expecting a form from, then check them off as they show up. If you’re missing a form or two, contact the company in question to check on its status.

W-2

Wages and other compensation from your employer

- Employer 1:

- Employer 2:

- Employer 3:

- Employer 4:

1099-INT

Earnings from a savings, CD, or other interest-bearing account

- Bank 1:

- Bank 2:

- Bank 3:

- Bank 4:

1099-DIV

Earnings from taxable investment accounts, like brokerage accounts

- Brokerage 1:

- Brokerage 2:

1099-MISC

Self-employment income or other money you made outside regular work and investments

- Client 1:

- Client 2:

- Client 3:

- Client 4:

- Client 5:

Tax Contacts

The IRS has several phone lines and many web pages you can refer to depending on your question or concern. To get faster answers and information, have your most recent tax return — and the tax return your question is about — handy.

You may also need to contact other professionals for assistance as you complete your taxes. Fill out the list below so you’ll have the information at your fingertips when you need it.

IRS Contact Information

- Ask a question about your personal taxes

- Call: 800-829-1040

- Visit: irs.gov/help/ita

- Learn the status of your refund

- Call: 800-829-1954

- Visit: irs.gov/refunds

- Ask a question for your business

- Call: 800-829-4933

- Visit: irs.gov/help/ita

- Access assistance while overseas

- Call: 267-941-1000

- Visit: irs.gov/help/help-with-tax-questions-international-taxpayers

- Retrieve a tax form or publication

- Call: 800-829-3676

- Visit: irs.gov/forms-instructions

- Get advanced support from the IRS

- Call: 877-777-4778

- Visit: irs.gov/taxpayer-advocate

Take Action

Fill out the important names section, then keep this information with the rest of your tax documents.

Important Names & Contact Information

- Your Accountant.

- Your Child Care Providers. Note: You’ll need each provider’s tax ID number in order to deduct child care expenses

- Your Employer’s HR Contact. For questions on your W-2 form

- Your Retirement Plan Administrator. For questions on your 1099-R form

- Your Health Insurance Provider. For questions on your qualified medical expenses

Your Marginal Tax Bracket Is…

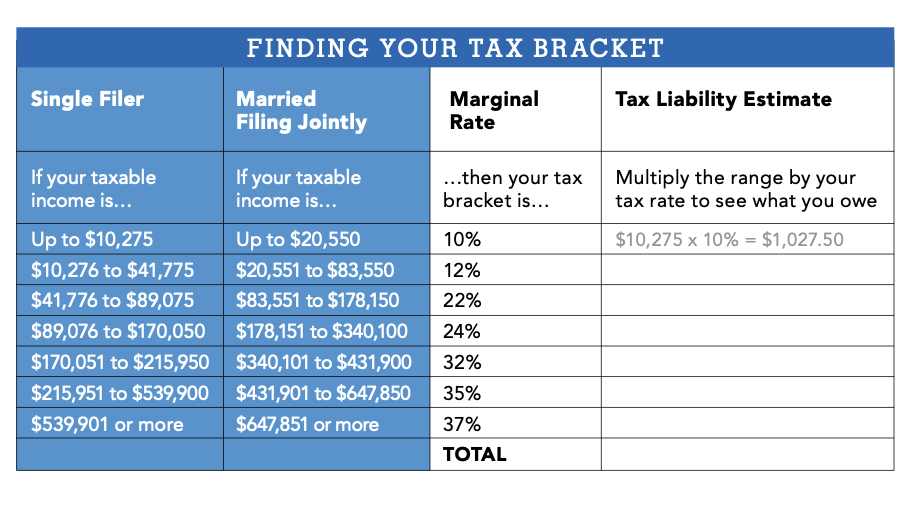

The government places you in a certain tax bracket depending on your income level. To do this, the IRS goes by your adjusted gross income (AGI), which is your total income minus adjustments, deductions, and exemptions.

The brackets are based on income ranges, and only the income that falls within that range is taxed at the rate listed. For tax year 2022, see the “Finding Your Tax Bracket” table.

How This Works

A single filer with $30,000 in taxable income has a 12 percent marginal tax rate. The progressive tax system means they will pay 10 percent income tax on the first $10,275 they make and 12 percent on income up to $41,775. Taxable earnings in the next income range will be taxed at 22 percent.

Take Action

Highlight the row that corresponds to your income and tax bracket. Multiply the amount of your taxable income that falls within a given range by the marginal tax rate listed in the adjacent column. Then total that column to get an estimate of your total tax liability. (Get the exact number by filling out your tax forms to completion.)

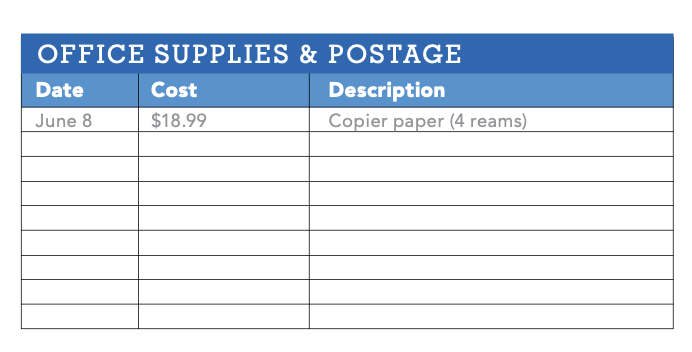

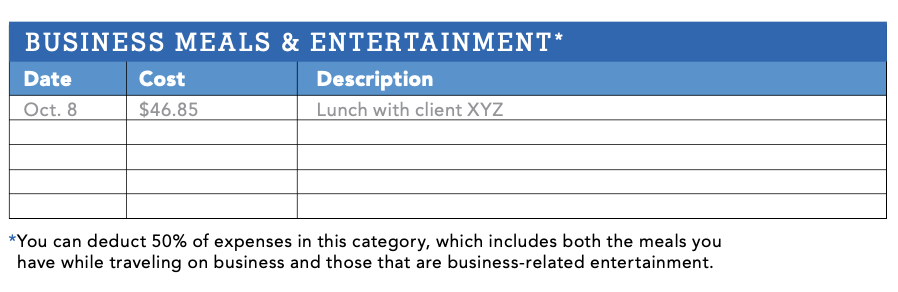

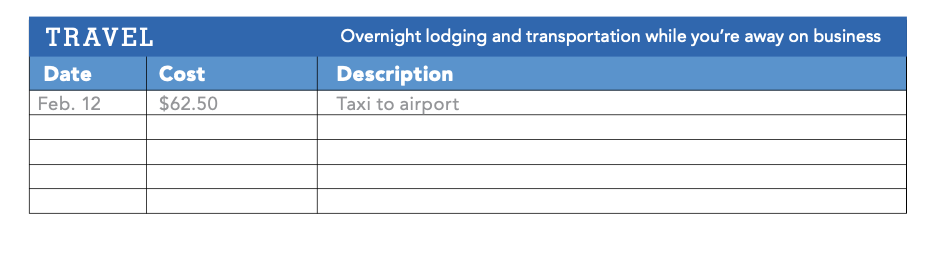

Business Expense Tracker

If you run your own business, it’s easy to lose track of small expenses. But keeping a record of items like that new file cabinet or a client coffee can ensure that you report your costs accurately — and maximize your business deductions.

Take Action

Keep copies of these sheets with you while you go about your day. Use them to ensure you capture all the business expenses you incur at home and when you travel.

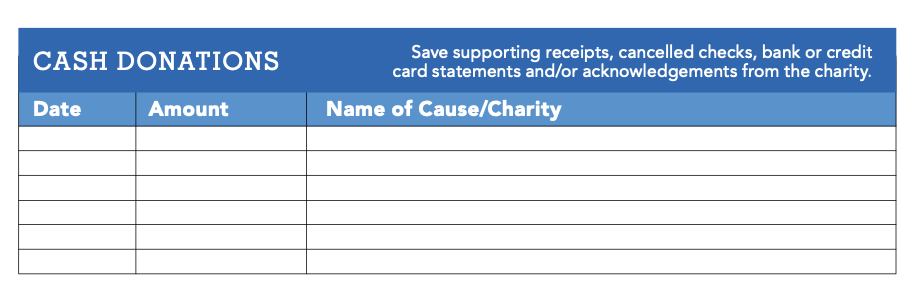

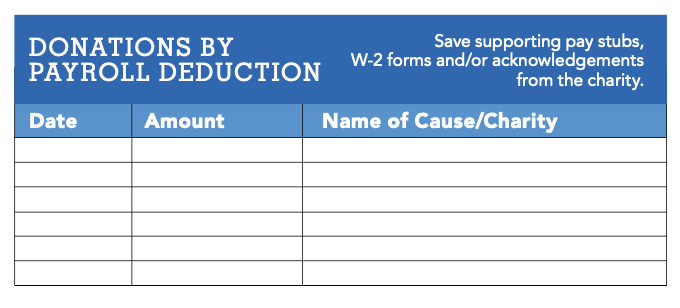

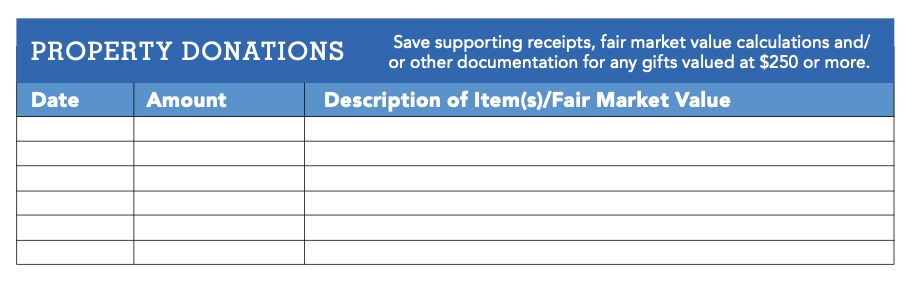

Charitable Giving

This chart can help you keep track of the donations you’ve made throughout the year. You can deduct these donations on your tax return, should you choose to itemize deductions.

Take Action

Keep this sheet in the front of your charitable giving file. Add an entry and supporting documentation any time you make a donation.

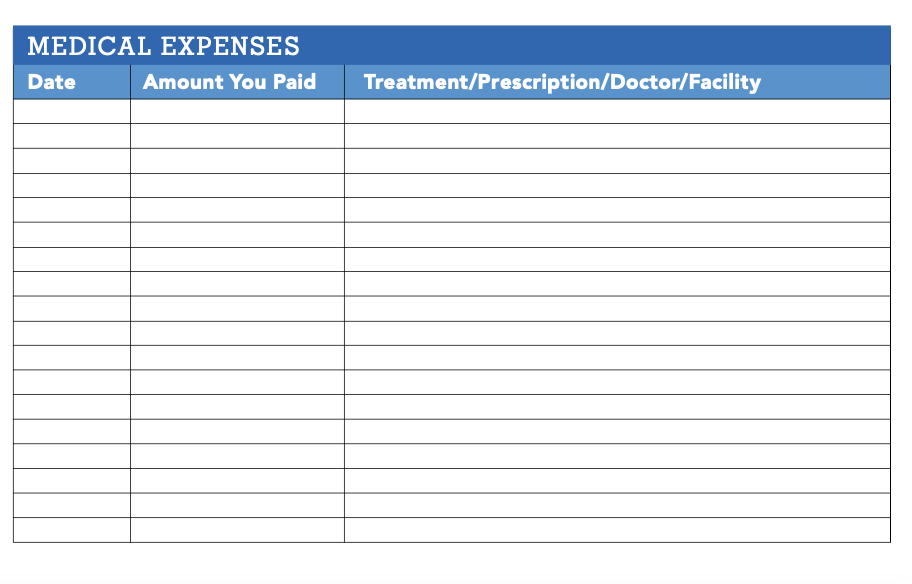

Medical Cost Tracker

If health care costs take up a large part of your budget, you may be able to deduct some of them on your tax return. If you itemize your deductions, you can deduct medical costs that exceed 10 percent of your adjusted gross income, so be sure to keep a record of every qualifying expense.

The following items count as deductible medical expenses, if you meet the 10-percent threshold:

- Ambulance

- Contact Lenses

- Dental Exam

- Nursing Home Care

- Physical Exam

- Psychiatric Care

- Smoking-Cessation Programs

- Transportation

- X-rays

Take Action

Use this sheet to track your annual medical expenses. For a detailed list of qualified medical expenses, see IRS Publication 502, Medical and Dental Expenses.

A version of this article appeared in our partner magazine, The Essential Tax Guide: 2023 Edition.