Income Tax Forms and How To Read Them: A Simple Guide (with Visual Explainers)

Learn to read tax forms like a pro.

Organizations and individuals that pay you money — whether a company, a financial institution, or a person who hires you as contractor — typically must report how much they paid you to the IRS. They’re also required to send you a copy of that information, which is why you receive income tax forms in the mail from each source of income with information about your wages and other earnings.

Knowing how to read these income tax forms is important, as it enables you to accurately report your income on your tax return. Here’s a look at common income forms, and some key items to pay attention to.

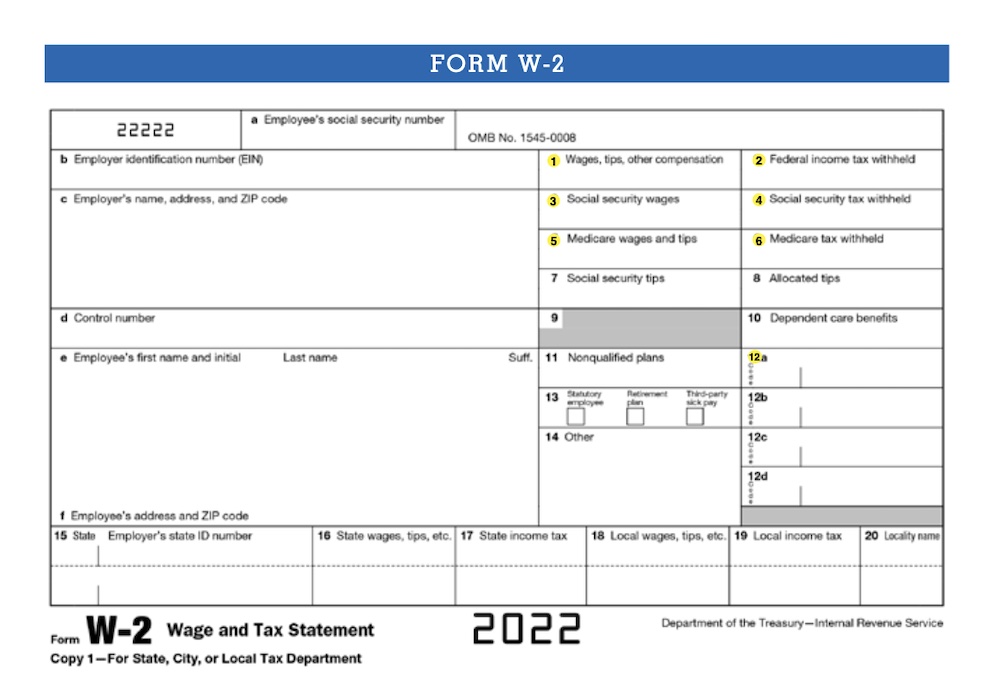

Form W-2

Also known as the Wage and Tax Statement, this form documents the income you have earned as an employee. It also includes a tally of the total tax you have paid so far through withholding. Employers are required by law to get these income tax forms to you by January 31. You must include a copy of the form (from each employer, if you have more than one job) in your annual return.

Box 1

This is the total amount of your year’s pay that is subject to income tax. This total does not include any contributions you made to a 401(k) or other workplace retirement plan. It also doesn’t include payroll deductions for pretax benefits, such as health and dental insurance premiums.

Boxes 2, 4, 6

As you earn money through the year, your company withholds a portion of your paycheck on an ongoing basis in order to pay your taxes to the government. These three boxes display the total amount of federal, Social Security, and Medicare taxes you have paid during the year.

Boxes 3 and 5

Although the money you save in a 401(k) or other workplace retirement plan — along with some other pretax benefits — is shielded from income tax, it is subject to Social Security and Medicare taxes. As a result, your total wages reported here will likely be higher than in box 1.

Box 12

The line items in box 12 may display employment related information that can affect your tax filing. Each is specified by a letter code located on the left side of the box. For example, if you made retirement plan contributions you’ll see the amount listed in box 12d. Or there might be an amount listed for reimbursed business travel (code L) or a company contribution to your health savings account (code W).

You can find a complete list of the codes in the IRS General Instructions for Forms W-2 and W-3 here.

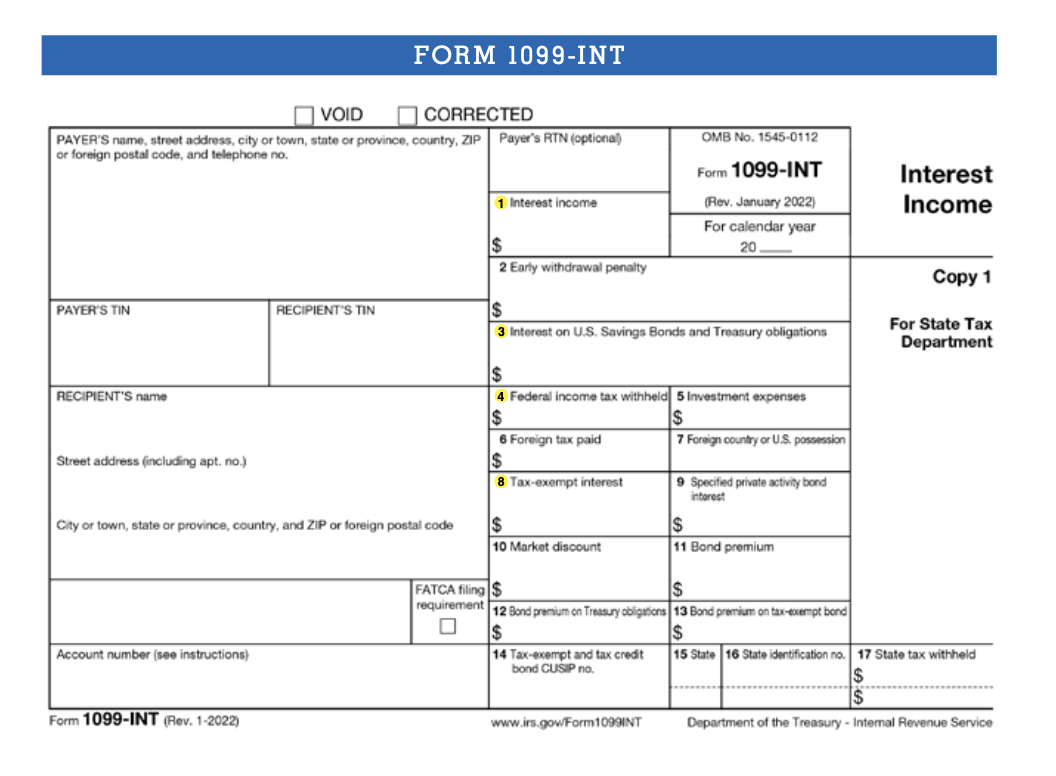

Form 1099-INT

Whenever you earn $10 or more in interest on a savings account, certificate of deposit (CD), or other interest-bearing account, the bank or government agency holding your money will send you a Form 1099-INT. You should expect to receive it by January 31. You don’t need to attach the 1099-INT to your return when you file it, as you do the W-2, but you do need to enter the relevant information on your return.

Box 1

This is the taxable interest you earned during the calendar year.

Box 3

This is the interest you’ve earned from US Savings Bonds, as well as Treasury bills, bonds, and notes. A portion may be taxable at the federal level, but all of it is exempt from state and local income tax.

Box 4

If the bank or agency has already withheld some of your federal tax liabilities from your interest, that total will appear here. Note that if you haven’t sent the entity your correct taxpayer ID information, it will automatically withhold a portion of your earnings.

Box 8

If you earned interest through municipal bonds issued by a state, local, or city government, those earnings are exempt from federal taxes. You will find that tax-free balance here.

Find the IRS General Instructions for Form 1099-INT here.

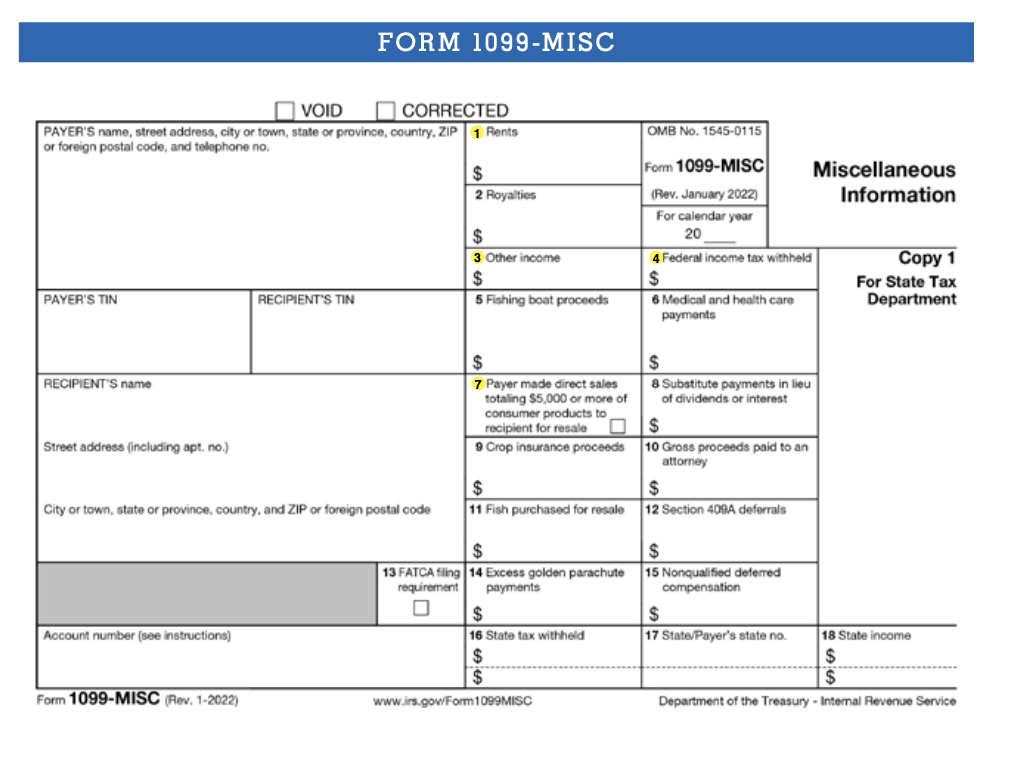

Form 1099-MISC

This form serves as a catchall for any money you make that isn’t part of wages from an employer, interest earnings, or investment income. It’s most commonly seen by self-employed workers. These forms must be issued by any individual or business that paid you more than $600 during a given tax year. They must file the forms with the IRS and send you a copy by January 31. You might also receive a 1099-MISC if you earned income from leasing property to a business, or if you have won a cash prize.

Box 1

If a person or business paid you $600 or more for office space, prizes and awards, medical payments, or payments to an attorney, they’re required to report that amount to you in this box.

Box 3

Income that doesn’t fit in any other category will appear here. Examples may include prize winnings and awards, or wages due to a deceased employee for whom you were named as a beneficiary.

Box 4

Unlike on the W-2 form, the 1099-MISC form generally won’t include taxes that have been taken out, since the income reported here generally isn’t subject to withholding.

Box 7

If you sold $5,000 or more of consumer products outside of a permanent retail establishment, you’ll mark this box.

A version of this article appeared in our partner magazine, The Essential Tax Guide: 2023 Edition.