IRAs and 401(k)s: What’s the Difference Between These Retirement Savings and Do They Have Tax Credits?

Your retirement account questions, answered.

The government provides many tax-advantaged tools to encourage you to save for retirement, including retirement accounts and tax credits. These tools help you reduce your taxes, which in turn allows you to save even more money. The tools you decide to use will depend on whether you want to lower your taxes now or in the future. Here’s what you need to know about retirement account taxes and the tools that are available to you.

Pretax Retirement Accounts

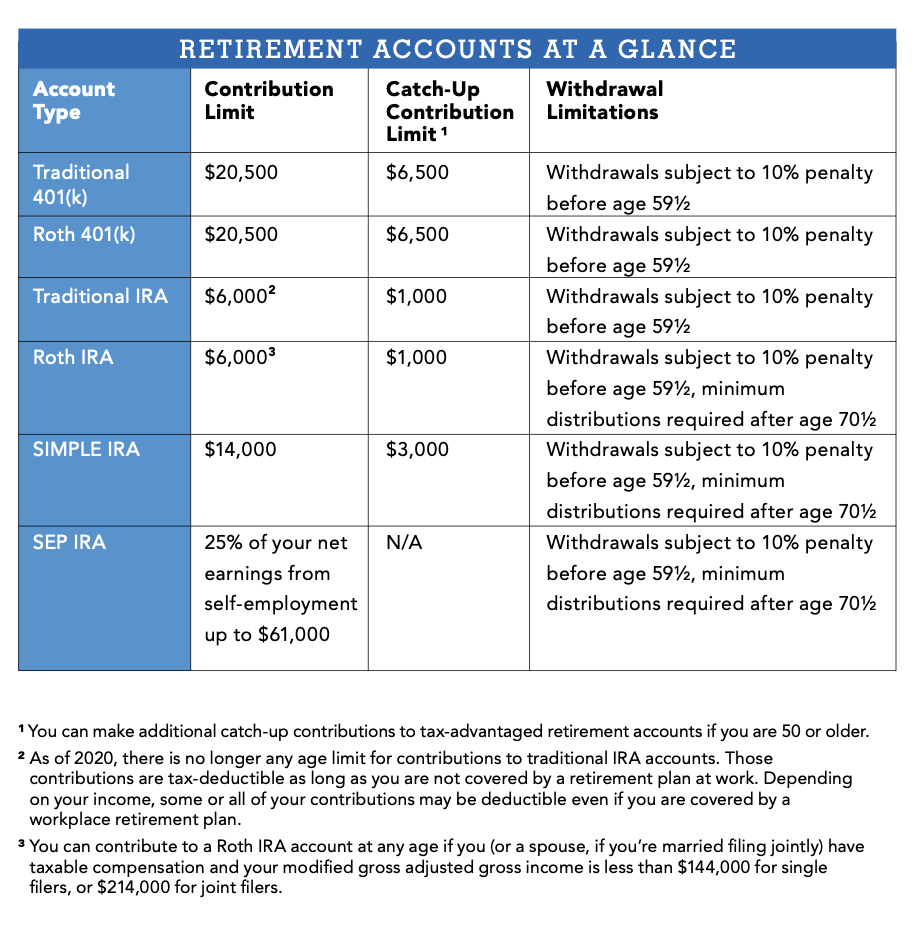

You can contribute to some retirement accounts with pretax money — meaning the money is not taxed before you put it in your account. These accounts, which are also called tax-deferred accounts, offer a way to reduce your tax bill now. Common pretax accounts include:

401(k). A 401(k) is an employer-sponsored retirement account that allows you to set aside a portion of your paycheck before taxes are taken out. This serves to reduce your taxable income, lowering the amount you pay in income taxes. Your employer may contribute to the account as well. For example, say you make $50,000 a year and your employer offers a 3 percent match. If you contribute at least 3 percent of your annual salary, or $1,500, your employer will put an additional $1,500 into your account.

Most plans offer participants a choice of mutual funds to invest in. The money in a 401(k) has the potential to grow tax-free until you begin making withdrawals in retirement. At that point, your withdrawals will be taxed as ordinary income. There are some restrictions on 401(k) accounts, including contribution limits.

Traditional IRA. A traditional individual retirement account (IRA) is another form of tax-deferred retirement saving. If you meet certain requirements, your IRA contributions are tax-deductible, which assists you in lowering your income tax now. As with a 401(k), there is no tax impact on your earnings until you begin taking withdrawals during retirement. A custodian such as a bank or retail broker holds the account, and you will typically have a wide range of investment options available to you based on the offerings of your custodian.

SIMPLE IRA. Savings Incentive Match Plan for Employees (SIMPLE) IRAs can be opened by any employer, including self-employed individuals. As with a 401(k) plan, a SIMPLE IRA lets employees make pretax contributions. Employers must make matching contributions or nonelective contributions, which are paid to employees whether or not they contributed themselves. Employers can take a tax deduction based on their contribution, and withdrawals from the account are taxed as ordinary income.

SEP IRA. Simplified Employee Pension (SEP) IRAs are traditional IRAs designed for self-employed individuals. Any business owner with one or more employees can open one, as can anyone with freelance income. Only employers may make contributions. These contributions are tax-deductible for the business owner and are held in the SEP account in the employee’s name. Withdrawals are subject to income tax.

Looking for even more ways to earn money when you’re done working? Watch this video on Creative Ways to Boost Retirement Income.

After-Tax Retirement Accounts

Retirement accounts that use after-tax dollars are not taxed when you withdraw from them in your retirement. If your tax burden at that point is lower than it is now, however, you’ll end up reducing your lifetime tax burden. Here are two frequently used after-tax accounts:

Roth IRA. The main difference between a traditional IRA and a Roth IRA is that Roth IRAs are funded with after-tax dollars. Your contributions and any earnings grow tax-free, and your withdrawals generally are not subject to income tax. Contributions are not tax-deductible. Though you won’t see tax benefits now, you will benefit by paying no income tax later, when you withdraw the funds.

Roth 401(k). Roth 401(k)s function just like traditional 401(k)s, except your contributions are made with after-tax dollars and are not subject to tax when you make withdrawals in retirement. These accounts are often used by people who plan on their tax bracket being higher in retirement than it is now.

You can make contributions for tax year 2022 to all IRA accounts through April 18, 2023. Note that contributions to 401(k) accounts must have been made by December 31, 2022. Be sure to comply with income and eligibility requirements for the account you select.

Retirement Savings Contributions Credit

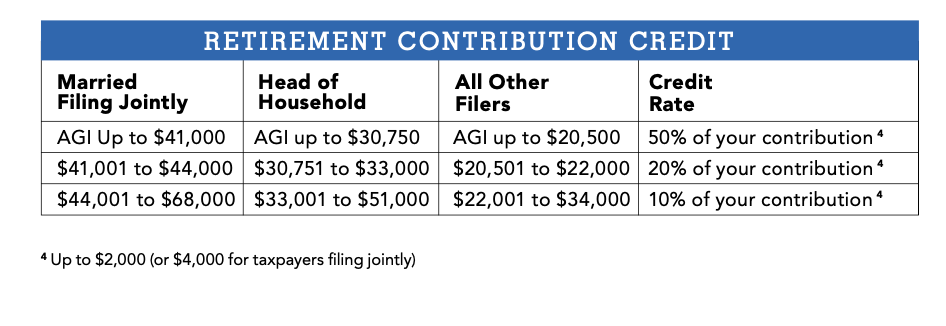

When you contribute to your retirement plan, you may be able to take advantage of the retirement savings contributions credit, or saver’s credit, to reduce the amount you owe on your taxes dollar-for-dollar. To claim the saver’s credit, you must be 18 or older, and you can’t be a full-time student or be claimed as a dependent on anyone else’s taxes. The amount of the saver’s credit is equal to a percentage of your contribution up to $2,000 and depends on your filing status and AGI. The chart below can help you calculate this credit for 2022.

Check IRS Form 8880 to make sure that you qualify for the saver’s tax credit before you take it. Go to irs.gov/retirement-plans for up-to-date information on retirement account contributions and withdrawals.

A version of this article appeared in our partner magazine, The Essential Tax Guide: 2023 Edition.