Should You File Your Own Taxes or Hire a Professional?

Know what's best for your financial situation.

Filing your taxes — from gathering your paperwork to adding up the numbers — can be an overwhelming task. Fortunately, there are ways to make the process a little bit easier. Before you begin, consider whether you’d benefit from hiring a tax preparer or if it’s better to file your own taxes. Here’s a list of things you’ll need to know before you make your decision.

Hiring a Pro

First, the bad news: Hiring a tax preparer doesn’t mean you’re totally off the hook for organizing your taxes. To prepare your return, the person you hire will need information and documents that only you can provide. Even so, using a pro will reduce the time you spend doing your taxes and help ensure that your return is accurate.

Tax Preparers vs. CPAs

Tax preparers are trained specifically to help you prepare income tax returns. Meanwhile, a certified public accountant (CPA) — who must pass a certification exam and have a background in accounting and finance — typically has expertise in a wide range of accounting skills, from performing audits to preparing financial statements for businesses and individuals.

When You Need a Pro

Hiring a pro can be particularly helpful if you have a complicated financial situation — you own multiple properties, have a lot of investment activity, run a business or work as a freelancer, or have a high income and are looking for ways to reduce your tax bill. CPAs typically know the tax system front to back. On top of that, they’re required to take continuing professional education courses to stay up-to-date on the latest tax codes and regulations.

CPAs use sophisticated software that reduces the chance for human error to affect the accuracy of your return. If you’ve hired an accountant and the IRS determines there is a mistake on your tax return, depending on the situation, some of the liability may fall on your accountant. Developing a long-term relationship with a CPA who understands your family’s finances can also be an asset in terms of planning for the future. Accountants can assist with financial and estate planning, as well as provide expert advice that can lower your tax liability.

What It Costs

For some, the cost of hiring an accountant is a small price to pay for the amount of money you can save in the long run. The average cost of hiring a professional accountant to prepare and submit an itemized Form 1040 and a state tax return is $220 without itemized deductions, according to the National Society of Accountants. Using a tax preparer can be considerably less expensive than hiring a CPA. (Remember, these costs can vary depending on where you live, as well as the complexity of your family’s tax situation.)

How to Find One

If you decide to go with a pro, ask for recommendations from friends and colleagues. All legitimate preparers are required to have a Preparer Tax Identification Number (PTIN) from the IRS. This can be verified on the IRS website. If a preparer doesn’t ask for last year’s tax return to get an idea of your situation, consider going elsewhere.

Working Together

When you’ve chosen a tax preparer, ask how he or she wants to receive your information. Many CPAs send clients a tax organizer that outlines the information they need to prepare your return. You’ll also need to provide documentation of your income, including W-2 and 1099 forms, as well as information on the sale of investments, business or rental incomes and the like. In addition, your tax preparer will need expense-related documents, including those that detail interest you’ve paid on student or home equity loans, business expenses and receipts for charitable donations. Finally, make sure you review your tax preparer’s work for accuracy before you sign the return.

Doing It Yourself

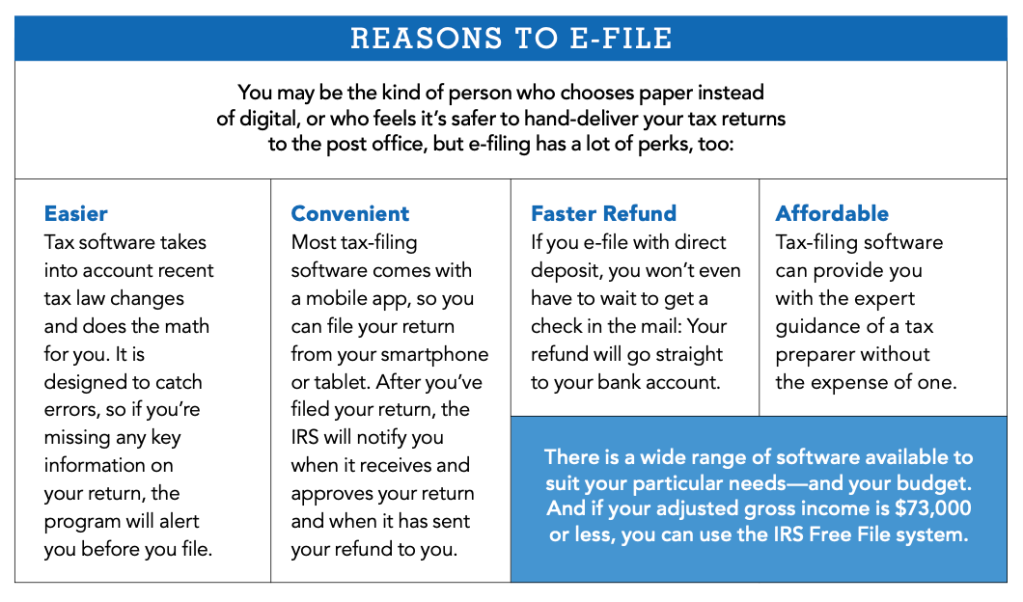

If your financial situation is fairly straightforward — you’ve got minimal deductions, sources of income, and investments — hiring a tax pro may be overkill. You can save money by filing your own taxes with the help of a tax software system. See the table below.

How It Works

Once you’ve gathered all the necessary paperwork, including income documents and expense-related receipts and paperwork, it shouldn’t take more than an hour to input the information and find out how much you owe — or the size of your refund. Most tax software programs complete the calculations automatically, saving you from doing the math yourself. They’ll also flag potential errors so you can double-check that you’ve put the right information in the right place. After you submit your return, you’ll get an immediate notification of receipt and can check your status at any time. E-filing also means that if you’re entitled to a refund, you’ll receive it sooner than if you’d sent in a paper return. Learn more about electronic filing options at irs.gov/filing/e-file-options.

What It Costs

Tax software runs from approximately $30 to $200, while some websites even offer their software for free. Many of these programs offer chat help, phone services, and life-events guidance, should you get bogged down by the details. Nowadays, most come equipped with mobile apps, so you can even file your taxes conveniently from your smartphone.

What To Be Aware Of

While e-filing can provide a convenient and affordable alternative to hiring a professional, there are risks associated with doing so. A 2016 audit conducted by the Online Trust Alliance (OTA) found that nearly half of tax software packages offered under the IRS’s free-file program initially failed cybersecurity protocols. To protect yourself, the OTA recommends filing your tax return as early as possible. This can decrease the risk that someone files a bogus tax return in your name. You should also stay up-to-date on your software, which includes installing any necessary updates for your device’s operating system.

A version of this article appeared in our partner magazine The Essential Tax Guide: 2023 Edition.