Reducing Your Tax Bill: Take Advantage of Tax Credits and Deductions Available to You

Understand the difference between the two.

When filing your taxes, you’ll want to take advantage of all tax credits and deductions available to you. This can help reduce your tax bill significantly. However, it’s important to understand the difference between credits and deductions. One difference is that credits provide a dollar-for-dollar reduction of your taxes, while deductions provide an indirect tax reduction by lowering your taxable income, thus reducing your total tax bill. There is a wide variety of credits and deductions available, though which ones you qualify for will depend on your circumstances.

Tax Credits

Tax credits directly reduce the amount you owe — a $500 credit means you pay $500 less in taxes. Credits are typically offered to help offset certain expenses, including buying a first home, child care costs, adopting a child, caring for elderly parents, or energy-efficiency projects, such as installing solar panels. Business owners can also take advantage of tax credits. Tax credits are less common than tax deductions. They are worth varying amounts, and whether or not you qualify will be based on factors such as filing status, age, employment, and education. There are two main types of tax credits, which operate in different ways: refundable and nonrefundable.

Refundable Tax Credits Are the Most Versatile Credits You’ll Encounter

They are subtracted in full from the amount of taxes that you owe after deductions, and can be used to increase your refund. These credits offer the unique ability to reduce your tax liability to less than zero. Say you owe $500 in taxes, and you’re eligible for a refundable credit of $800. Your tax liability will be reduced to negative $300, and the IRS will give you a $300 refund. Some of the most common refundable credits include the additional child tax credit, the earned income tax credit, and the health coverage tax credit.

Nonrefundable Tax Credits Reduce the Amount of Your Income Tax Up to the Amount of Income Tax You Owe

A nonrefundable credit can’t reduce your tax liability below zero. Nonrefundable credits expire in the year that you claim them and can’t be carried over to the next year. Common examples include the adoption tax credit, the child tax credit, the foreign tax credit, and the mortgage interest tax credit.

Understanding Tax Deductions

Tax deductions reduce your income tax bill indirectly by lowering your taxable income. The amount you receive in tax deductions is dependent on your marginal tax rate, also known as your tax bracket. For example, if you are in the 24 percent bracket, then a $1,000 deduction will reduce your taxes by $240, or 24 percent of $1,000. There are two types of deductions: the standard deduction and itemized deductions. As a taxpayer, it’s best to use whichever amount is greater.

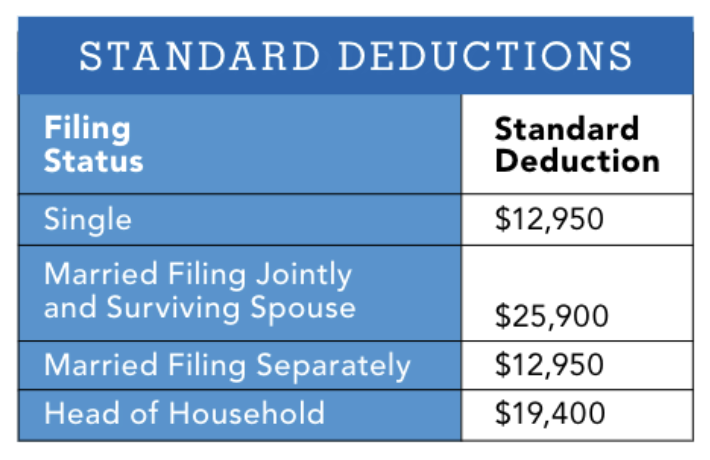

Standard Deduction

Most people take the standard deduction. The amount you can claim is based upon your filing status, and that amount is adjusted for inflation each year. See the table below for 2022 figures.

Itemized Deductions

You may choose to itemize if the total of all your deductions is greater than the standard deduction. You can only deduct expenses determined by the IRS, which include some medical expenses, some state and local taxes, mortgage interest, investment expenses, charitable contributions, and some job-related equipment; all require documentation.

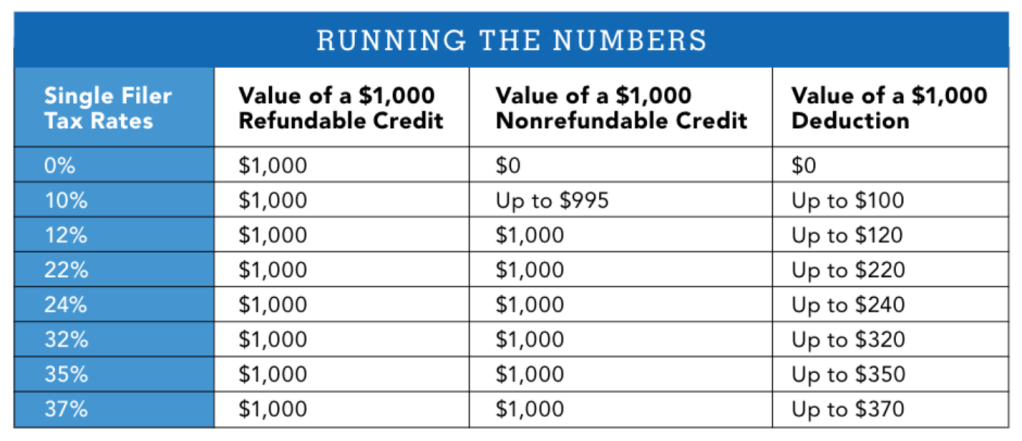

The Impact of Deductions and Credit

Various tax credits and deductions can affect your tax bill in different ways. The table below illustrates the impact of deductions and credits of the same value for four different taxpayers. The taxpayer with a 0 percent tax rate has no taxable income, so they can only take advantage of a refundable tax credit, and only if they have earned income. (Their taxable income could have been reduced to zero by tax deductions.) Because they’re paying no taxes, nonrefundable credits and tax deductions cannot reduce their tax bill.

A taxpayer in the 10 percent tax bracket could take advantage of the full refundable credit, but only a portion of the nonrefundable credit; that credit cannot reduce their income tax to below zero. The maximum income tax someone in the 10 percent bracket will pay is $995, so the $1,000 nonrefundable credit can only reduce taxes by that amount. The deduction for someone in the 10 percent bracket is $100 — 10 percent of $1,000. Filers in the 24 percent and 35 percent brackets can take full advantage of both credits for a deduction of $240 and $350, respectively. Before taking any tax credits or deductions, check IRS rules to make sure you qualify.

A version of this article appeared in our partner magazine The Essential Tax Guide: 2023 Edition.