The US Uses a “Progressive” Tax Code — But What Does That Mean?

Get acquainted with the US tax code.

Income tax — a tax on money made from jobs and other sources — is the largest revenue source for the US government. Although originally controversial, it has become a key principle of the US tax code. It’s used to pay for public goods like roads, schools, libraries, and first responders. While tax rates are always changing, the US tax code has been “progressive” since the 1860s. Here’s what that means for you.

Progressive vs. Regressive vs. Flat Taxes

People who make more money are taxed at a higher tax rate than those who make less money under a progressive tax code. For example, if people who make $10,000 per year have to pay 10 percent of their income in taxes, while those who make $50,000 per year have to pay 20 percent, and those who make $100,000 per year have to pay 30 percent, that’s a progressive tax.

A regressive tax is the opposite of a progressive tax. People who make less money are taxed at a proportionately higher rate than people who make more money. Under a regressive tax code, someone making $100,000 per year would owe a smaller percentage of their income in taxes than someone making $10,000.

Meanwhile, a flat tax — say, 10 percent of income — imposes the same proportional tax on everyone, regardless of their income. In this scenario, higher earners and lower earners pay taxes that are roughly equivalent to one another. A flat tax would make filing taxes easy — but perhaps not as fair for all US taxpayers.

Benefits of a Progressive Tax Code

As complicated as doing your taxes can be, there are good reasons for having a progressive tax code. First, it increases government revenue by collecting more from those who can afford to pay more. This generates more money for important public services. Second, it eases the burden on lower earners and gives them a greater chance to achieve success. Third, it helps to correct imbalances that occur due to rules that result in dividends and capital gains being taxed at a lower rate than other forms of income.

Understanding Tax Brackets: Not All Income Is Taxed The Same

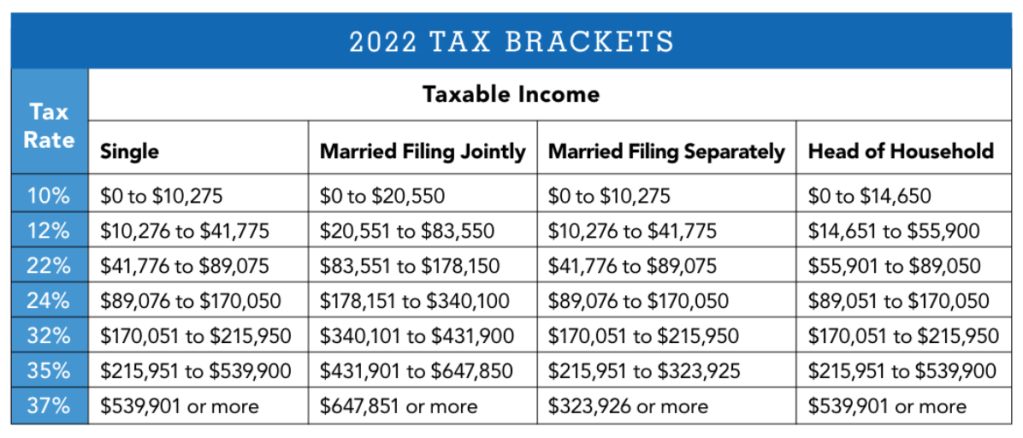

Our progressive tax works by placing earners into different tax brackets according to how much money they make. There are currently seven official federal tax brackets, with rates ranging from 10 percent to 37 percent. The dollar amounts that define the brackets change depending on whether you’re a single filer, a married joint filer (or qualifying widow/widower), a married separate filer, or a head of household filer.

To get an idea of how the brackets change based on your filing status, see the 2022 Tax Brackets table below.

Why This Matters: Understanding Your Marginal Tax Rate

Determining which tax bracket you fall into isn’t as simple as just adding up your total income and finding the correct row on the table. Instead, you must calculate your taxable income (sometimes referred to as “adjusted gross income”). This is your total income minus adjustments, deductions, and exemptions.

US tax filers can choose between subtracting a standard deduction or a list of itemized deductions. The standard deduction is a fixed dollar amount each year. Itemized deductions can include child care expenses, charitable giving, education expenses, select

business costs, mortgage interest, certain medical expenses, and more.

If you’re near the lower end of a tax bracket, deductions can not only reduce your taxable income, but send you into a lower bracket, significantly reducing the taxes you owe. Once you’ve determined your taxable income, it’s important to understand that not all of the income will be taxed at the same rate (unless you fall into the tax bracket for the lowest earners).

Say your taxable income is $75,000. The first $9,950 of this will be taxed at 10 percent, the rate of the first tax bracket. Earnings between $9,951 and $40,525 will be taxed at 12 percent, the rate of the second tax bracket. Only the remaining $34,475 of earnings will be taxed at 22 percent, the rate of the third tax bracket.

The top tax bracket you fall into is your “marginal tax rate.” So someone with a taxable income of $75,000 has a marginal tax rate of 22 percent, even though only $34,475 of that income will be taxed at that rate. Although there are seven main tax brackets, the percentage of income owed varies, even between taxpayers in the same bracket.

A version of this article appeared in our partner magazine The Essential Tax Guide: 2023 Edition.