Pride & Processes: How the CFO of Liquivida® Turned a $500 Investment Into an 8-Figure Health & Wellness Franchise Company

Organized and balanced, with a knack for spreadsheets and numbers, Shayna Tejada would never have labeled herself a “finance person.”

“I was always good with numbers and actually find them exciting,” she states. “Looking at sales revenue at the end of a good month or seeing a lot of zeros after a number on your bank balance is great. But it’s what those numbers represent, the story behind how they got there – that’s what really makes them interesting.”

How Liquivida’s numbers “got there” is a story in and of itself. When Tejada’s entrepreneurial spouse, Sam Tejada, decided to open the first Liquivida® location, she supported the effort, relying on her education and her experience working for a multi-franchise owner of a major bathroom remodeling company.

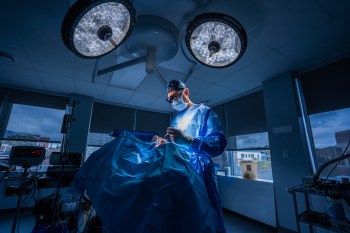

Shayna attributes the creation of partnerships to the success of Liquivida®, then an IV Lounge, and now a reputable health and wellness brand and franchise that focuses on optimal well-being through preventive therapies. Initially operating out of an existing medical office, the Tejadas split the revenue with the facility owner enabling Liquivida® to grow relatively quickly with starting capital of just $500.

But the Tejada team knew early on that branding and a standalone location was essential to the company’s success. They took a short-term loan of $10,000, paid it back in six months, and established “sweat equity” partnerships with a medical doctor and a marketing associate. This helped in the creation of marketing materials, medical protocols and SOPs with no additional expenses incurred. With the money saved on salaries, Shayna hired their first Liquivida® employee so Sam could work on the business, not in it. “When you’re starting out with so little capital, you have to be crafty. Anyone who tells you there’s no creativity in finance is lying,” she laughs

Joint Ventures are another creative tool that helped to grow Liquivida®. Entering into a joint venture with another company similar to Liquivida® helped increase cash flow by operating out of two locations. The next Joint Venture opportunity led to their first brick and mortar store, with the original lease holder asking if they wanted to assume the location. Shayna says that collaborations, partnerships, and joint ventures were key factors to saving money, adding to revenue and leveraging capital to grow the business.

As Liquivida® expanded to a full-service wellness center, the need for more stock and inventory meant more cash upfront to pay for it before recouping any money. “Leveraging terms with vendors gave us the opportunity to make money first and then pay for the product later,” Shayna says. She cautions that business owners need to be careful not to put themselves in a hole when leveraging terms and that managing company finances means always knowing what you owe.

Shayna says that she uses “the heck out of credit cards that offer good rewards”, paying the balances monthly and using the cash rewards to further support the business. This can add thousands to a bank account over time for items that are needed anyway.

While most entrepreneurs and salespeople care only about the money coming in and the size of the bank account, Tejada says those things tell you nothing. It’s about what’s behind the numbers. What products and services are selling? What are the COGS? What are the operating costs? What money is allocated for things like furniture and equipment versus operating expenses? “It can feel incredibly isolating at times. But I think that – and my propensity for processes are my biggest contributions to Liquivida®,” she says.

Processes were crucial to the oversight and growth of Liquivida®. From day one, Tejada ensured a process was created whenever something new developed – and still does today. Processes can uncover if you’re misusing a product, if a tool is ineffective, an employee is being careless, billing isn’t accurate or a delivery incomplete. Shayna cautions that if you’re not watching for it, you stand to lose a tremendous amount of money. Her team learned that a tool used to administer a service might have cost the company more than $100,000 in wasted product in a single year had they not had an inventory process in place and caught it early on. “From closing out cash drawers to product inventory, I know firsthand that checks and balances can literally save companies hundreds of thousands of dollars,” Tejada states.

Tejada didn’t realize that all along, she was creating financial controls. “When auditors inquired about operational processes that feed to the accounting division, I was like, yeah, we actually do have that. Three-way match, cash drawer recs, month end closing procedure, inventory audits, accrual-based revenue recognition. Those are financial controls, but early on, I didn’t realize that is what I was naturally doing.”

A decade later, as she interacts with financial professionals, from CPAs and auditors to fractional CFOs and data analysts, Tejada has come to an enlightening realization, stating “No one knows my business as well as I know it.” She says that knowing and monitoring key performance indicators is the key.

Reflecting on her evolution, Tejada feels she is the same person that she was 10 years ago, but a very different businesswoman. While the stresses are greater, so is her confidence in her company, in her team and in her own abilities. She empowers and feels empowered by the predominantly female leadership team at Liquivida®, actively engaging in everything from growth strategies to employee development, because she knows these are the stories behind Liquivida’s numbers. “People aren’t numbers, numbers represent people,” she states.

While the numbers may not always look good, particularly for new businesses, Tejada says success starts with mindset. “Perseverance is key and panic cannot be the default mode if you want to succeed in business. You get used to the fact that the sky is always going to be falling. It’s about how you handle it that matters.”

Contact: shayna@Liquivida.com

Medical Disclaimer: The content of this article is for informational purposes only and does not constitute medical advice or any kind of patient-provider relationship.