Understanding Taxes on Investments — And How To Reduce Your Taxable Savings Bill

What you need to know about capital gains, capital losses, and more.

Although you’ll owe taxes on the money you earn on taxable savings and investment accounts, these are still important tools for generating wealth. The amount of taxes you must pay depends on many factors, including the source of that income. Understanding investment taxes will help you make choices that can save money on your return.

What is unearned income?

The IRS labels money you earn on your taxable savings and investment accounts “unearned income.” Any money you earn over the year that doesn’t come from salary, wages, or tips falls under this unearned income category. Thus unearned income includes interest you earn on certificates of deposit (CDs), dividends from the stocks you own, or any capital gains on the sale of securities, such as stocks, bonds, and mutual fund shares.

Reporting Taxable Interest and Dividends

If your taxable interest income and dividends total $1,500 or less for tax year 2022, you can enter the value on your form 1040 on lines 8a through 11 — much as you do with the information you pull from your W-2. If not, you may need to report unearned income differently on your tax return.

If your investment income from taxable interest and/or dividends exceeds $1,500, you’ll need to report it separately on form Schedule B. That form, which you file along with your 1040, requires you to list the amounts and sources of your interest and dividend income rather than simply reporting it in aggregate. In most cases, the income from interest and dividends is taxed as ordinary income at your marginal tax rate.

Reporting Short-Term and Long-Term Capital Gains

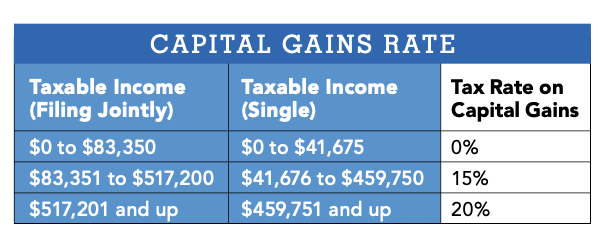

The IRS requires you to provide details about the sale of any assets (including financial vehicles like stocks, bonds, and mutual funds, as well as other assets you sell for profit, like a car, a house, or artwork) on Form 8949 and Schedule D. The tax rate on capital gains from such sales depends on how long you held the assets before selling them. If you purchased shares of a company in January and sold them later that year for a profit, it would be considered a short-term capital gain. Short-term gains are taxed at the same rate as ordinary income. If you held the stock for a year or more before selling, though, the profit would be considered a long-term capital gain and would be taxed at a more favorable rate — between 0 percent and 20 percent, depending on your taxable income.

Investors who buy and sell often tend to pay far more in taxes than those who buy assets and hold them for a longer period.

A Silver Lining in Capital Losses

When you sell a security like a stock or mutual fund for less than the purchase price, you incur a capital loss. Capital losses can reduce your tax liability by offsetting capital gains, and may also offset some of your earned income. For example, if your sale of mutual fund shares result in a $5,000 gain, but the sale of shares from another mutual fund resulted in a $5,000 loss in the same year, the gains and losses would offset each other, resulting in no net tax liability.

If your losses exceed your gains in a tax year, you can apply the excess losses to offset up to $3,000 ($1,500 if you’re married and filing separately) of your ordinary income. If your realized losses exceed that $3,000 limit in a given tax year, they can be carried forward to help offset gains and income in future years. This is how some investment losses can reduce your taxes.

Cutting Your Taxes Through Tax-Loss Harvesting

Some investors reduce their tax bills through a strategy known as tax-loss harvesting. The strategy involves selling an underperforming position before year-end to realize a loss that will offset gains you’ve earned on other holdings that year.

Your investment goals and your ability to tolerate risk should drive your investment decisions. But taking appropriate steps to reduce taxes on your investments can boost your returns significantly over time. What really matters in the end is not how much your investment returns are before taxes, but how much of those returns you get to keep.

A version of this article appeared in our partner magazine, The Essential Tax Guide: 2023 Edition.